The Potential of Japan’s Content Industry in the Global Market

Atsuo Nakayama

Entertainment Sociologist / CEO of Re entertainment

Lecturer at Keio University, researcher at Ritsumeikan University

Chief project manager of content IP at the Ministry of Economy, Trade and Industry (METI)

Member of the Content Strategy Working Group at the Intellectual Property Strategy Headquarters, Cabinet Office

External Director at Plott Inc.

The “New Cool Japan Strategy,” which was decided in June 2024, sets a goal of 50 trillion yen in foreign consumer spending (including exports and inbound tourism) across four key sectors—Food & Food Culture, Content, Fashion and Cosmetics, and Inbound Tourism—by 2033. Among these, the Content sector holds particularly high expectations, with a target of 20 trillion yen. Japan’s content industry, spanning anime, manga, and games, has earned widespread acclaim overseas. We spoke with entertainment sociologist Atsuo Nakayama about growth strategies, challenges, and key factors for success in global expansion.

Chapter.01 Japan’s Position in the Expanding Global Content Market

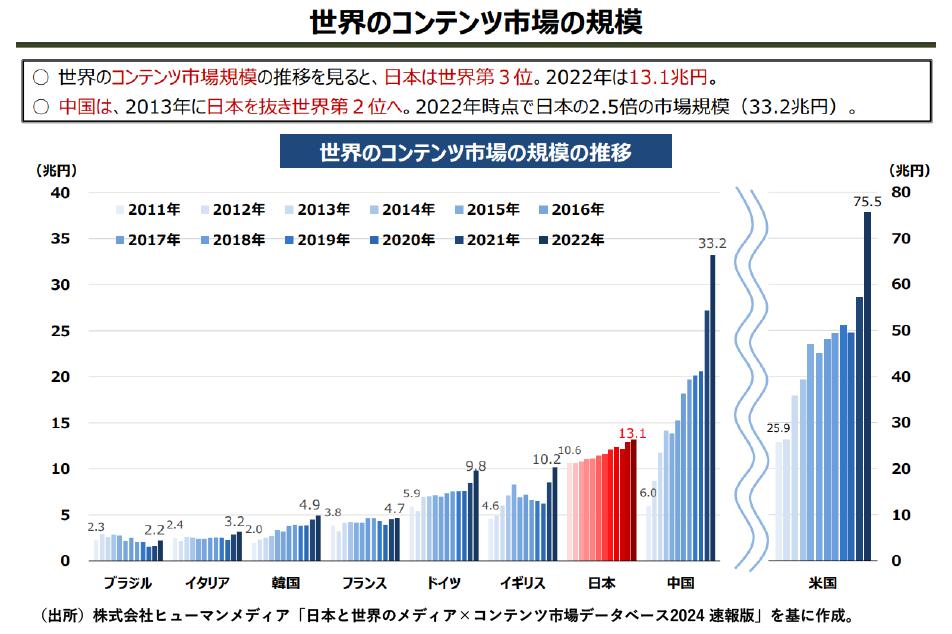

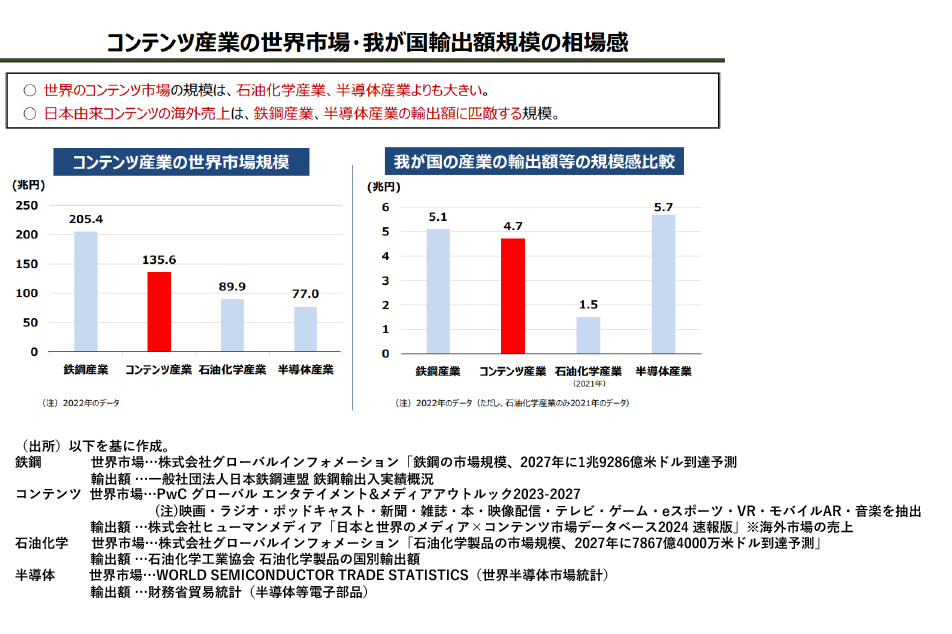

In 2022, the global content market reached a total size of 135.6 trillion yen, surpassing the petrochemical and semiconductor industries. The United States led with 75.5 trillion yen, followed by China at 33.2 trillion yen. Japan ranked third with 13.1 trillion yen. Furthermore, overseas sales of Japanese content are rival the export value of the steel and semiconductor industries.

Regarding future global market trends, entertainment sociologist Atsuo Nakayama predicts, “The global market is expected to continue expanding. While the U.S. market is mature, there is still room for growth. In China, even during economic downturns, Japanese entertainment continues to thrive, showing strong potential. Growth markets will see expansion due to increasing consumer populations, with the global market projected to grow at an annual rate of 5 to 10 percent. Southeast Asia, particularly Indonesia, Thailand, and Vietnam, has a high affinity for Japanese content, and with their growing consumer bases, they represent promising markets for companies considering international expansion. These regions were previously overshadowed by massive markets like the U.S. and East Asia. However, in the 2010s, the rise of the streaming era significantly boosted Southeast Asia’s presence. We are seeing an increasing trend where content that goes viral in Southeast Asia spreads globally. A clear example is the booming VTuber phenomenon in Indonesia.”

What characteristics define Japan’s content market?

Nakayama highlights key differences between Japan, China, and South Korea in terms of overseas revenue. “Japan surpasses China and South Korea in exports and imports of anime and home console games, while South Korea leads in live-action films, and China and South Korea outperform Japan in PC and smartphone games. While digital content is growing overall, some argue that Japan is lagging in terms of digital transformation. However, the real issue is not just digitization itself.”

“There is still demand for physical content 1 in the global market, an area where Japan excels. The challenge is not digitization per se, but rather how to build new distribution networks and business models. Digital tools are simply a means to an end. For example, in the music industry, digitalization has significantly influenced marketing strategies through data analysis. The key is ensuring that digital adoption enhances competitiveness rather than leads to a disadvantage.”

1 Physical Content – Tangible media consumers can own such as CDs, DVDs/Blu-rays, manga books, figures, and event-related merchandise.

Chapter.02 Unlocking the Keys to Global Expansion: Lessons from Successful Character IP

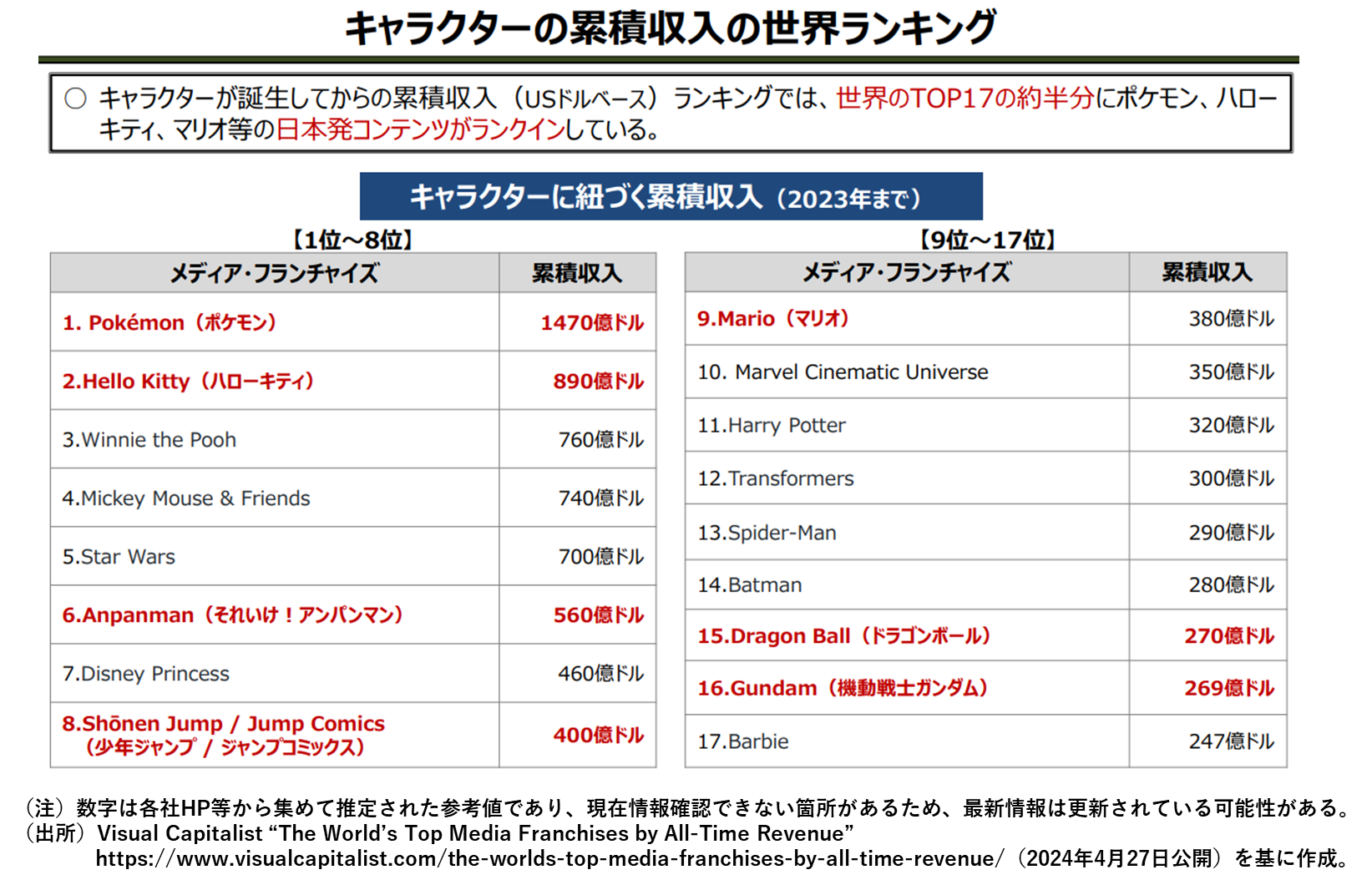

The IP business is experiencing rapid growth within the content industry, with Japanese franchises accounting for nearly half of the world’s top character-based economies generating over 20 billion dollars. Iconic brands such as Pokémon and Hello Kitty have established strong global footprints. As part of a project with Japan’s Ministry of Economy, Trade, and Industry (METI), entertainment sociologist Atsuo Nakayama analyzed the key factors behind the success of internationally successful character IPs.

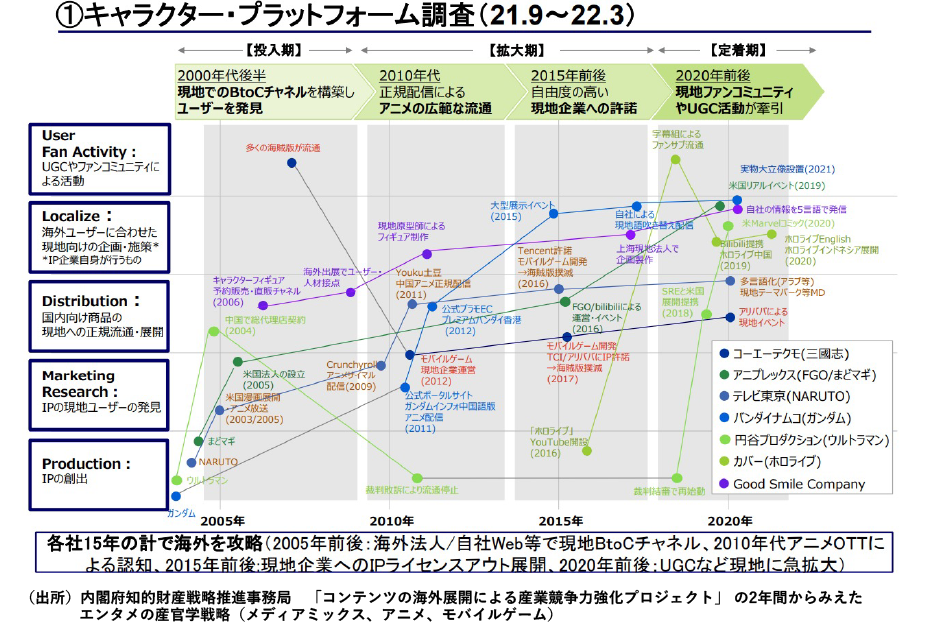

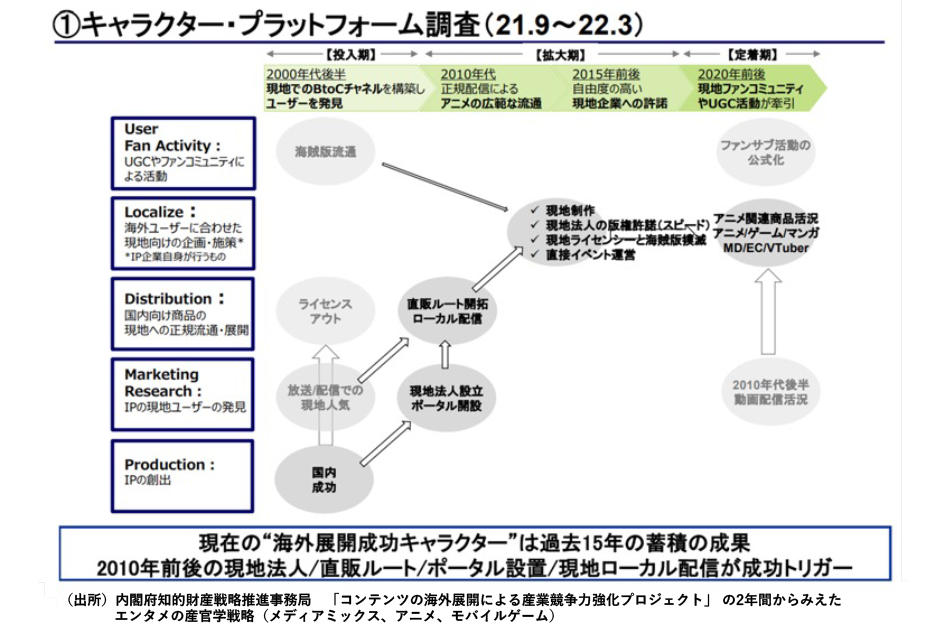

“Looking at the expansion process of companies that have successfully entered the global market, we see that many have taken around 20 years to establish themselves overseas. Common steps include setting up overseas subsidiaries around the year 2000, securing direct B2C channels via their own websites (with a retreat trend post-Lehman crisis), increasing awareness through anime OTT2 platforms in the 2010s, expanding through IP licensing to local businesses around 2015, and finally solidifying their presence through user-generated content (UGC3) by 2020. The key success factors include establishing local subsidiaries, developing direct sales routes, leveraging local streaming services, producing localized content, and granting IP licenses to local entities in a timely manner.”

On the other hand, companies that struggle with international expansion often face challenges such as over-reliance on trading companies and distributors, leading to missed opportunities to develop in-house capabilities, as well as short-term decision-making, including withdrawing investments from overseas offices or business divisions too soon.

Nakayama emphasizes that talent development and retention are critical.

“It’s not just about hiring employees who can speak English. Successful expansion requires talent capable of making strategic business decisions in coordination with headquarters. Companies that succeed in global markets invest in local offices, leverage local talent, and maintain a long-term presence, typically for a decade or more. Without this level of commitment, securing a significant market share is unlikely. If a company lacks the right personnel internally, there are cases where businesses have successfully brought in talent from other industries with international experience.”

Another crucial factor in overseas expansion is ensuring that IP development is not handled solely in-house. This is particularly important in China, where partnering with a strong local enterprise can help facilitate the distribution of official products while simultaneously combating piracy. In many cases, these local partners actively support legal enforcement against counterfeit goods. The prevalence of pirated products often indicates an unmet local demand, which companies can interpret as a potential business opportunity.

2 OTT – Over The Top

A term for content delivery services provided over the internet, such as streaming platforms.

3 UGC – User-Generated Content

Content created and shared by users, including photos, videos, reviews, blogs, and other forms of media.

Chapter.03 Expanding Business Through Cross-Industry Collaboration Utilizing IP

A growing trend in the content industry is to measure revenue based on intellectual properties (IP) rather than by individual segments like manga, anime, or games. This shift is also influencing global expansion strategies, moving away from segment-specific business models to a media-mix approach which incorporates manga and anime originals, film adaptations, games, and merchandise sales. By considering all revenue streams associated with an IP, businesses can better identify potential growth opportunities and optimize their monetization strategies.

Collaborations between IP and different industries are creating new business possibilities. In some cases, partnerships with global toy manufacturers or real estate companies have played a significant role in facilitating overseas expansion.

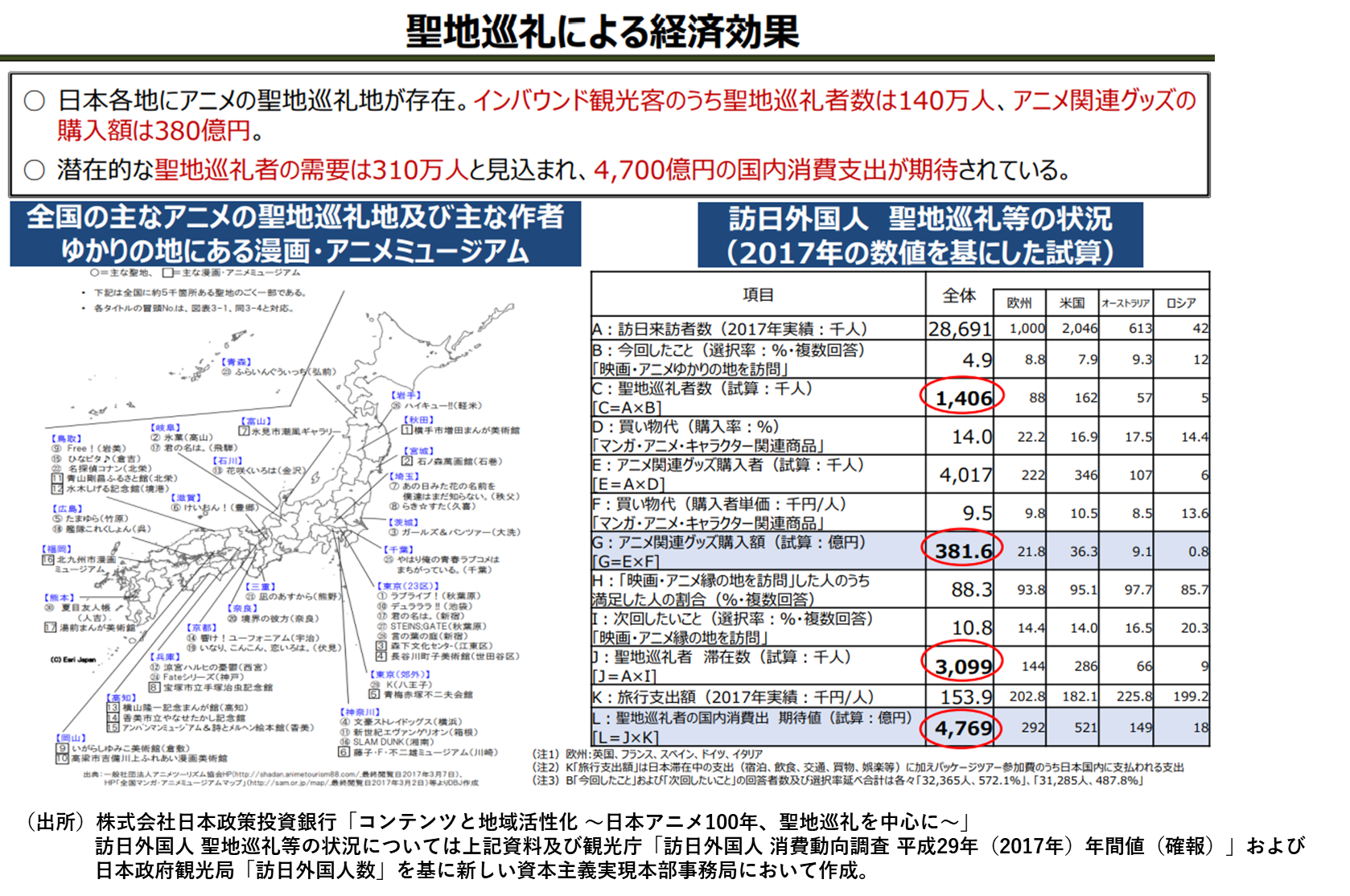

One of the most prominent examples of cross-industry collaboration is the tourism sector, particularly anime pilgrimage tourism, where fans visit real-life locations featured in their favorite anime. These anime pilgrimage sites exist all over Japan, attracting inbound tourists. As of 2017, 1.4 million visitors engaged in anime-related tourism, generating 38 billion yen in sales from anime-related merchandise.

Another notable initiative is the Kyoto Ani Monozukuri Award, Japan’s first award recognizing cross-industry collaborations between anime and other fields, such as manufacturing, technology, and traditional crafts. Nakayama emphasizes that:

“For successful collaboration, it is essential that the story and world of the IP align naturally with the business or industry involved.”

As anime continues to gain global popularity, utilizing IP can be an effective strategy for enhancing corporate and regional branding. However, a key challenge in overseas expansion is localization, which plays a crucial role in how an IP is received internationally. Nakayama highlights ‘translation’ as one of the most critical aspects of localization.

“Word choice can significantly alter the perception of a character. Instead of focusing on a ‘literal’ translation, it’s more important to adapt the language to fit the culture and lifestyle of the target country.”

To successfully expand overseas, businesses must present anime and game characters’ stories in a way that resonates with local audiences, ensuring the IP aligns with their interests and cultural context.

Japan’s Content Industry: Challenges and Opportunities in Global Expansion

“Japan’s content industry has historically relied on its large domestic market, which has hindered the accumulation of expertise in overseas expansion. While building a Japan-based global platform is extremely challenging, individual companies still have significant opportunities for growth,” says Nakayama.

Despite the immense global popularity of Japanese content, distribution and promotion are largely dependent on foreign companies, leaving Japanese firms with limited direct interaction with international users and few opportunities to develop their overseas business capabilities.

However, this very situation highlights the vast potential of Japan’s content industry. Even without direct control, Japanese content has gained enormous traction worldwide. To unlock this potential, a shift in mindset is needed, moving away from a domestic-first approach to an internationally oriented strategy from the outset, similar to how South Korea promotes its music and drama industries. Additionally, government support and public-private collaboration will become increasingly vital in facilitating global expansion.

In recent years, cross-industry collaborations leveraging Japanese IP have been growing, such as partnerships with different sectors and initiatives like anime tourism, which revitalizes local economies by attracting visitors to real-world locations featured in anime.

“The exceptional craftsmanship and unique creative sensibilities of Japanese creators continue to captivate fans worldwide,” says Nakayama.

For many international audiences, Japanese content serves as an entry point to discovering and appreciating Japan’s culture and identity. As global interest in Japan grows, the content industry is expected to play an increasingly significant role in expanding Japan’s fan base and strengthening its cultural influence worldwide.

Written by: Mari Kanematsu

Interview Date: Nov. 14, 2024

Please note that the content of this article is based on information as of the interview date.